415 c limit 2024 Defined benefit irc 415(b) limit explained

If you are searching about Setting Up Limits for Qualified Savings Plans you've came to the right place. We have 25 Pics about Setting Up Limits for Qualified Savings Plans like Defined Benefit IRC 415(b) Limit Explained | PD, Defined Benefit IRC 415(b) Limit Explained | PD and also Employee Fiduciary on LinkedIn: #401k #safeharbor #401kplans. Here it is:

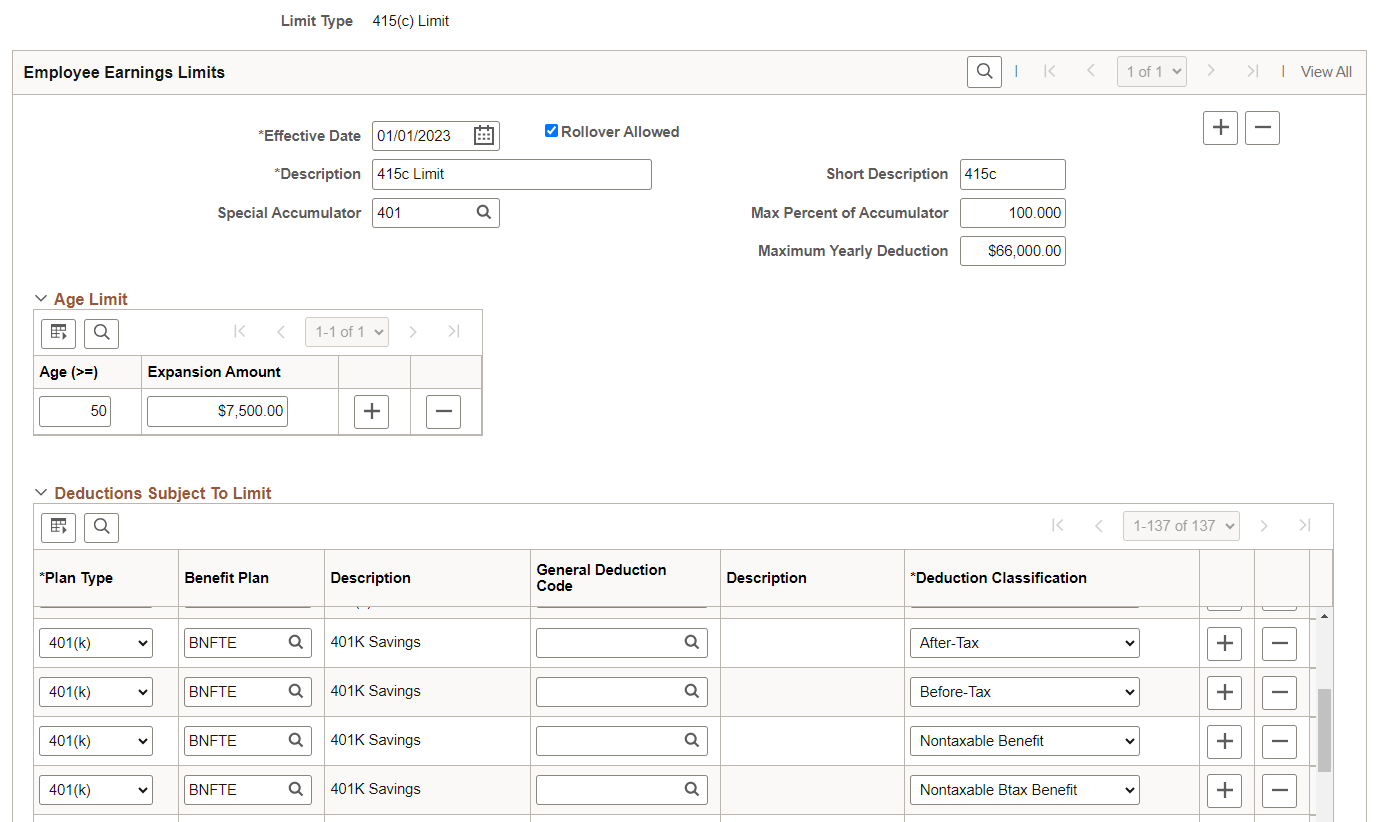

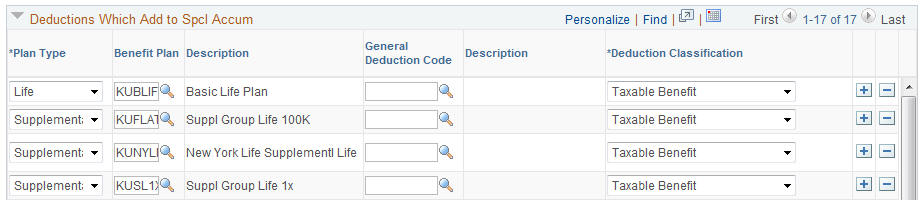

Setting Up Limits For Qualified Savings Plans

docs.oracle.com

docs.oracle.com

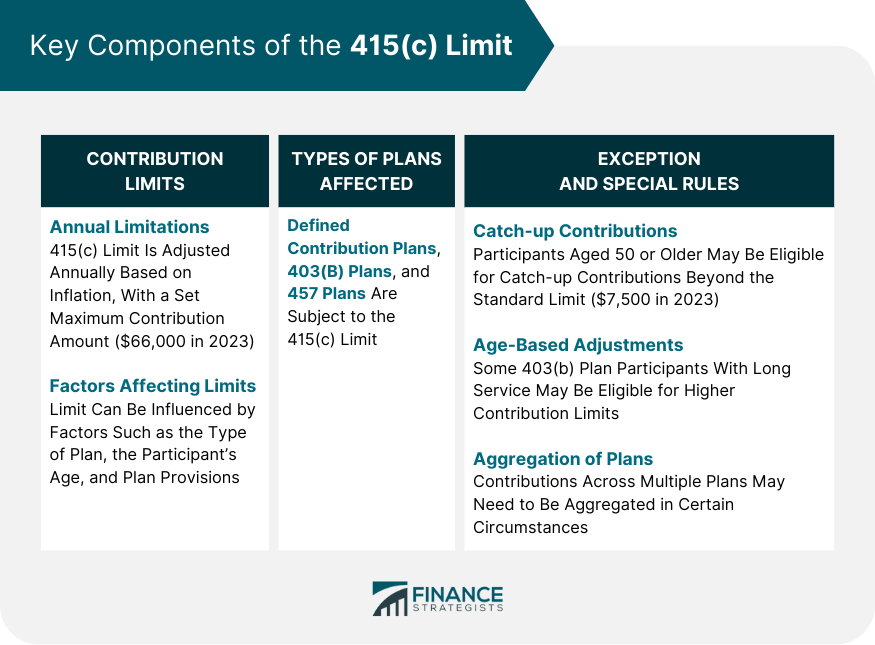

415c Limit 2024 - Clara Freddie

georgiannawgussie.pages.dev

georgiannawgussie.pages.dev

Irs 415 Limit For 2024 - Camile Martguerita

ruthemyrtia.pages.dev

ruthemyrtia.pages.dev

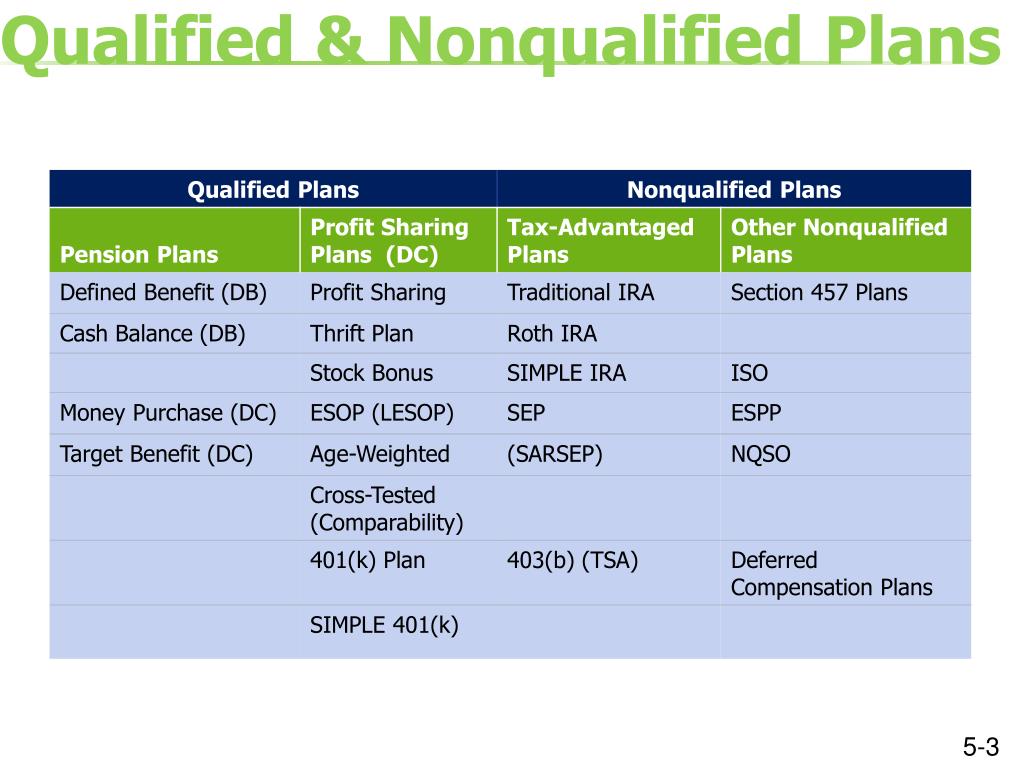

PPT - Session 5 Fundamentals Of Defined Contribution Plans PowerPoint

www.slideserve.com

www.slideserve.com

plans qualified contribution defined session fundamentals ppt powerpoint presentation module retirement

415c 2024 Contribution Limit Irs - Tate Zuzana

hannisqmarcela.pages.dev

hannisqmarcela.pages.dev

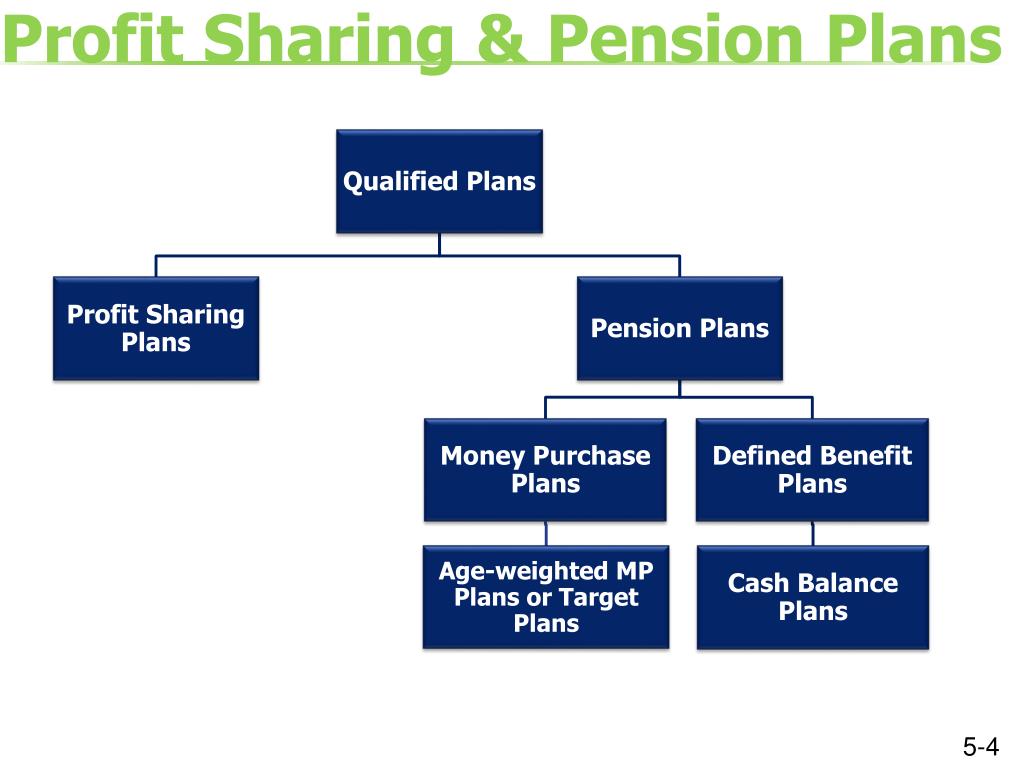

PPT - Session 5 Fundamentals Of Defined Contribution Plans PowerPoint

www.slideserve.com

www.slideserve.com

plans contribution pension sharing defined session profit fundamentals module ppt powerpoint presentation

415c Limit 2024 - Clara Freddie

georgiannawgussie.pages.dev

georgiannawgussie.pages.dev

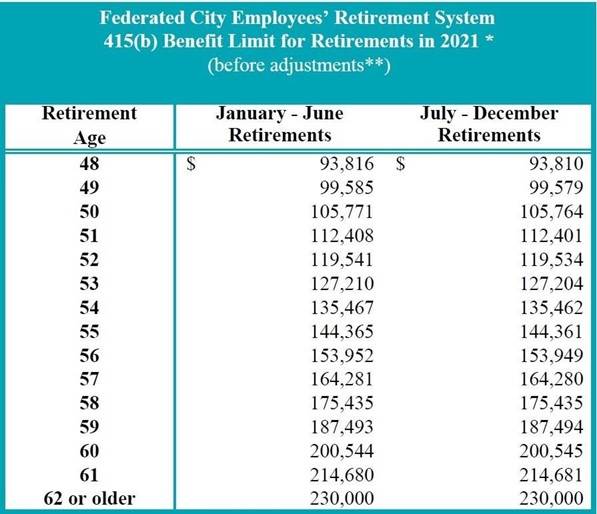

Defined Benefit IRC 415(b) Limit Explained | PD

www.pensiondeductions.com

www.pensiondeductions.com

Setting Up Limits For Qualified Savings Plans

docs.oracle.com

docs.oracle.com

limits limit table plans

Maximum 401k Contribution 2024 50 Years Old - Rhona Lavina

darbiegeorgianne.pages.dev

darbiegeorgianne.pages.dev

415c 2024 Contribution Limit Irs - Zia Lilyan

alizaylaural.pages.dev

alizaylaural.pages.dev

415 Limit For Non Calendar Year - Staci Elladine

janithqtracee.pages.dev

janithqtracee.pages.dev

415 Limit 2024 - Reeva Celestyn

aubreeqnatasha.pages.dev

aubreeqnatasha.pages.dev

Maximum Hsa Contribution 2024 Over 55 Family - Ola Lauryn

wynnebpapagena.pages.dev

wynnebpapagena.pages.dev

415 Contribution Limits 2024 - Perry Brigitta

tonyaqjessamyn.pages.dev

tonyaqjessamyn.pages.dev

IRS Announces New Contribution Limits For 2023

www.pfgadvisors.net

www.pfgadvisors.net

Pinterest Titeres De Mano - Buscar Con Google Felt Puppets, Glove

www.pinterest.es

www.pinterest.es

puppets puppet titeres glove

Employee Fiduciary On LinkedIn: #401k #safeharbor #401kplans

www.linkedin.com

www.linkedin.com

Coordinating Contributions Across Multiple Defined Contribution Plans

www.kitces.com

www.kitces.com

combined instance companies

Irs 415 Limit For 2024 - Cathie Randie

elysialilias.pages.dev

elysialilias.pages.dev

Roth 401k 2024 Limits - Davine Merlina

maggiewmelba.pages.dev

maggiewmelba.pages.dev

Social Security Income Tax Limit 2024 Ny - Jodi Rosene

dehliabenedikta.pages.dev

dehliabenedikta.pages.dev

Richert Beil Berlin Spring 2024 Fashion Show | Vogue

www.vogue.com

www.vogue.com

Defined Benefit IRC 415(b) Limit Explained | PD

www.pensiondeductions.com

www.pensiondeductions.com

Roth 2024 Contribution Limit Irs - Maia Lauralee

shirleenwjania.pages.dev

shirleenwjania.pages.dev

Roth 2024 contribution limit irs. Coordinating contributions across multiple defined contribution plans. Maximum 401k contribution 2024 50 years old